Background

In 2021, the Payments Data Community of Practice (COP) emerged out of the concluding Downgrades COP with two primary objectives. First, to offer some best practices to the increasingly complex process of managing payments data that merchants rely on to operate their business. Second, to conduct a study that gives merchants a tool to benchmark their own performance against metrics including, but not limited to, authorization performance, chargebacks and fraud statistics, tender share trending, interchange and downgrade management, and so many other KPI’s that are unique to retailers. We looked at these efforts in two distinct elements:

- State of Payments Performance Benchmarking Study: A study available only to merchants around performance metrics as a benchmark for merchants. This effort is still a work in progress, but we are excited to preview that we will be bringing back the fan-favorite live polling at MAG’s 2023 Mid Year Conference & Tech Forum in partnership with W. Capra to facilitate gathering this benchmarking data. These live polling results will give key insights in order to deliver a payments performance benchmarking report for our merchant members mid-2023.

- Voice of the Merchant Study: A study around how merchants are thinking about the current state of the payments industry. What types of alternative payment methods are merchants considering implementing? How has the merchant shopping experience evolved to meet consumers where they expect merchants to be? How are merchants structuring their payments teams in order to rise to the demand of payments becoming more of a strategic asset to companies? This study was conducted by Oliver Wyman over a period of several months and included a combination of live interviews with select merchants as well as a brief survey open to all MAG merchant members in order to gather the valuable insight necessary to produce compelling output. Below is an Executive Summary from that study and what you can expect next.

Voice of the Merchant Study - Executive Summary

This study yielded so many valuable nuggets of information that will allow merchants to not only assess the current state of the market and understand how their peers are tackling the biggest payments challenges of our time, but also action against those challenges within their own organizations.

- COVID happened - now what?: COVID upended merchant operations and required them to think creatively to not only keep their (figurative and literal) doors open but to adjust to consumer expectations. Many of these changes are here to stay.

- Cost reigns supreme with merchants’ priorities: Managing the complex cost of accepting payments continues to be the top priority for merchants - but has evolved into a delicate balance that must consider the user experience, operational challenges, reporting, and negotiation tactics vs. what was once a (relatively) simple math exercise.

- Payments has become a strategic center within retail organizations: Payments traditionally has been seen as a cost center and a necessary evil to business operations, but has grown into a strategic tool that executives are understanding more and more - from selecting the right alternative payment providers to gaining better insight into customer purchasing behaviors.

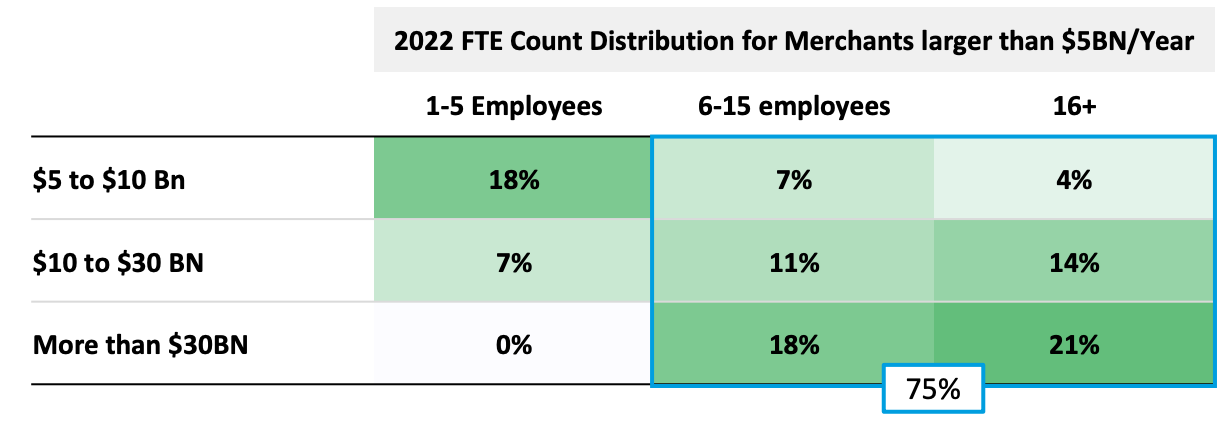

- Payments teams have expanded - both in size and scope: Not only has headcount increased on payments teams, but the functions performed have evolved drastically - from managing relationships to P&Ls, balancing authorization performance goals with consumer experience, to changing lines of business and channels in which payments are accepted. This trend will continue in the coming years as merchants become more sophisticated.

- Partner roles have expanded: Merchants historically just managed an acquiring relationship - but now find themselves needing to take on more partners in order to meet their growing business needs and customer expectations. This has led to a complicated partnership ecosystem that requires careful relationship management, negotiating prowess, and a thoughtful strategic approach.

- Merchants are as prepared as they can be for tackling change: With payments teams growing, cross-functional groups understanding more and more the importance of looping payments experts in earlier, and merchants becoming more agile to change given the rapid pace of innovation over the last several years, merchants are more than ever prepared for the future.

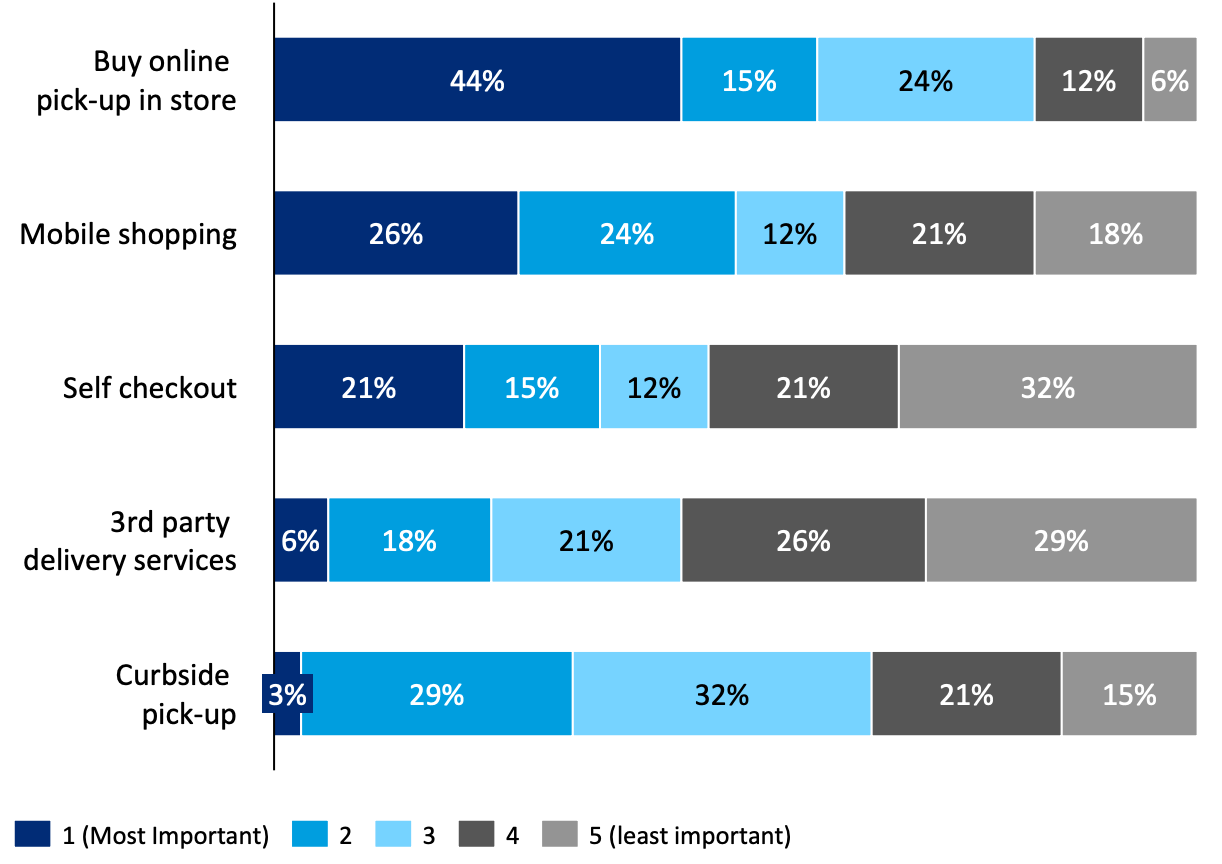

44% of merchants identify Buy Online, Pickup in Store (BOPIS) as the #1 most important shopping trend to their business

“We saw the greatest amount of business shift to BOPIS [out of the new pandemic-driven methods of acceptance]”

75% of merchants with $5Bn+ in annual volume have a payments team composed of at least 6 FTE’s (full time equivalent)

“We don’t have a single payments strategy; we have a multitude of them across regions and businesses”

What’s next?

- Live session discussing the study: Beth Costa and Laura Townsend took to the stage at the 2022 MAG Annual Conference & Tech Forum on merchant-only day to discuss highlights and headlines from the 2022 study. MAG Merchant Members: watch a recording of this session here.

- 2023 Voice of the Merchant Study: MAG plans to conduct this study on an annual basis as the industry continues to evolve over the coming years. The next annual study will get underway in early 2023, with publication in summertime. If you are a merchant and interested in being interviewed for the 2023 study, please reach out to Karina Bellorin!

- 2023 State of Payments Report: As mentioned earlier, we will be conducting live merchant polling at our 2023 Mid-Year Conference & Tech Forum to paint a picture of merchant performance and provide a benchmarking tool to members. Don’t miss it and be on the lookout for the report by early summer 2023.

/new-website-headshots/eric-194x221555d6f5b-cc89-4523-9498-c1695b3f63ad.png?sfvrsn=f76fdbe7_14)